We are using cookies on our website to ensure that you will receive the best experience while using our website. These cookies might relate to your information, your preferences or your device. The information does however not usually directly identify you, but it could provide you with a more personalized and better web experience. Since we do respect your privacy, you can choose to not allow some type of cookies. For more information on the types of cookies and the possibility to change the default cookies setting, click on the heading of the individual types of cookies. Blocking some types of cookies may impact your user experience on our website. For further information on how we process your personal data (cookies) please click on the section "More information about cookies”.

It is necessary to create a cookie to remember the choices you have made within our cookie privacy menu as well. This is going to have a couple of consequences:

Strictly necessary (technical) cookies are necessary for the functioning of our website and can therefore not be switched off in our systems. These cookies do not [collect or] store any personal identifiable information. They are usually a response to your actions and related to a request for services such as setting your privacy preferences, logging in or filling in the forms.

These cookies allow us to count the visits and the traffic sources on our website so that we can measure and improve the performance of our website. The performance cookies are supposed to help us to understand which sections of our website are the most and least popular and show how visitors move around the website. All the information that these cookies collect are aggregated and therefore anonymous. If you prefer to not allow these cookies, we will not be aware of when you have visited our website and we will not be able to monitor the performance of the website.

Functional cookies enable the website to provide you with enhanced functionality and personalization. These cookies are set by external administrator - to protect user data from unauthorized access. If you do not allow these cookies, then some or all of these services may not function properly.

At PPF banka, your online Debit Card payments can now be confirmed via the PPF banka e-Token app or an e-PIN combined with an SMS authorisation code.

Besides meeting the requirements of the EU’s PSD2 Directive, it is also a secure and simple way of confirming payments.

Safety first

Security is in the hands of state-of-the-art technology.

No need for SMS authorisation codes or e-PINs

Confirm your online payment with a single click in e-Token. That’s all there is to it. No more entering authorisation codes received by text message or memorising e-PIN numbers.

Fast and convenient

The e-Token app is always just a tap away on your phone. You can set up notifications to alert you to every online payment.

Access to our Internet banking

An Android or iOS smartphone

Online payments enabled for your Debit Card

The PPF banka

e-Token app installed and activated

2. Activate and sign up for e-Token

Activate and sign up for e-Token in our Internet Banking. A step-by-step guide can be found on our website.

Correct status

Incorrect status

3. Enter the card details

On the payment gateway, enter the required card details: the card number, expiration date and CVC/CVV code. You are then redirected to a payment confirmation page.

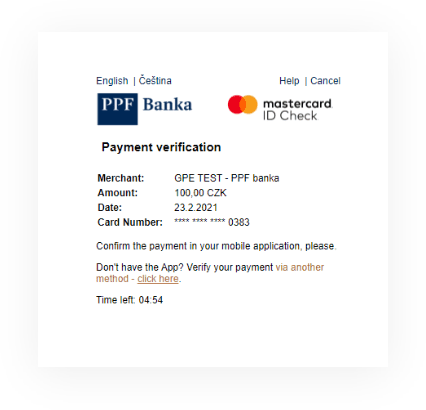

4. Payment details

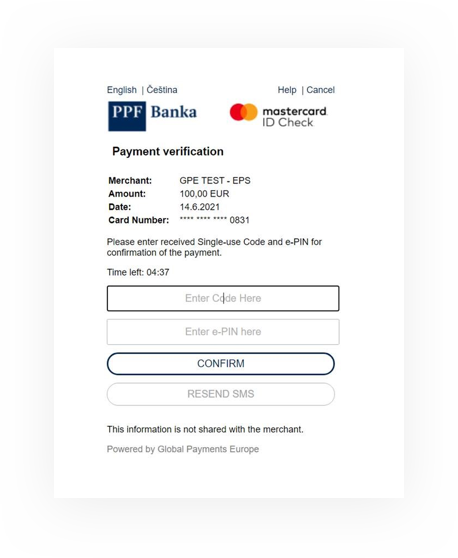

If you have activated e-Token, you will see a page with payment details and a five-minute countdown.

If you haven’t activated the app or if the app currently cannot be used to confirm the payment, the option of confirming the payment by entering the e-PIN and one-time authorisation code from a SMS message will be automatically displayed to you.

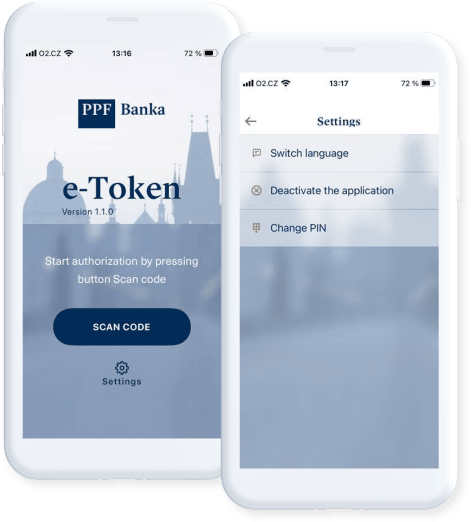

5. Opening e-Token

If you have activated the e-Token app and are able to use it, open it via the notification in your phone (if you have notifications on – we recommend allowing them when downloading the app) or click on your e-Token directly.

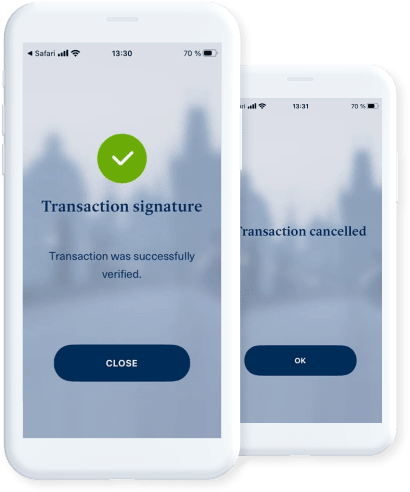

6. Confirm or decline an online payment

If you confirm (sign) an online payment, it will be sent and you will see a screen showing that the transaction has been successfully completed. If you decline an online payment, it will not be made and the transaction will be cancelled.

Within 5 minutes of receiving a notification in the app, you can choose another method to confirm a payment.

An e-PIN is a six-digit security number that is entered together with an authorisation code received via text message.

If you hold multiple Debit Cards, each will have its own e-PIN.

There is no time limit on the validity of an e-PIN and it remains the same for all online payments.

Enter the card details

On the payment gateway, enter the required card details: the card number, expiration date and CVC/CVV code. You are then redirected to a payment confirmation page.

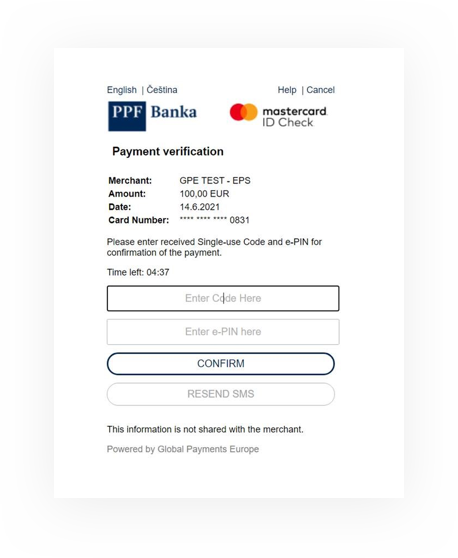

Enter the e-PIN and authorisation code

Enter the e-PIN and the one-time authorisation code received by text message. Both of these numbers need to be entered.

Confirm the payment

Confirm the details you have entered and checked, and the payment will be made. Otherwise, the payment will be cancelled.

This app is a simple way of confirming online payments and is an alternative to the other option, which is to enter an e-PIN and an SMS authorisation code.

The app is available on Google Play and the App Store.

You can activate and sign up for the app via our Internet banking (IB). This means that, besides holding a card, you also need to be an IB User. If you don’t have access to IB, please contact your relationship manager.

Yes, if you hold a card issued for someone else’s account (typically a business card issued for an employer’s accounts), the Bank may set your access so that you see only your cards and the transactions you have made with them. There is then no need for account holders to be worried that you, as a Cardholder, will gain access to other data.

There is another way you can confirm payment (by entering an e-PIN and an authorisation code that is sent to you via text message). More details can be found here.

Not if you use an e-PIN together combined with a one-time SMS authorisation code to authorise online card payments. More details can be found here.

There are also certain exceptions, defined by law, where e-Token payment confirmation is not necessary. These are situations where strong authentication is not required (e.g. the payment is for a small amount or for a recurring subscription).

Strong (two-factor) customer authentication (SCA) is mandatory for online payments within the EU. Online payment confirmation via e-Token may therefore not be required if you make a payment to a merchant outside the EU. In the EU itself, there are SCA exemptions, such as recurring subscriptions, parking fees, and amounts below EUR 30.

Please contact your relationship manager or customer support (+420 224 175 902) to agree how to proceed.

No, an e-Token is linked to a specific Holder. Once a Holder activates their e-Token, it will automatically be used to confirm online payments made with all of the Holder’s cards that have been issued by the Bank.

A personal secret security code used to confirm online payments made by Debit Card at merchants, especially within the EU.

You will receive an email notifying you of your e-PIN the next working day after you activate your card or internet payments. Your e-PIN will simultaneously be made available to you in your Internet banking (under Debit Card Detail). You can also change your e-PIN here.

Please start by checking your email inbox’s spam folder. Feel free to contact us through your relationship manager, by email at customer.service@ppfbanka.cz, or by telephone on (+420) 224 175 902.

If you are an Internet banking (IB) user, there is no need to search around – your e-PIN will be directly in your IB’s Debit Card Detail.

You can view your e-PIN in your Debit Card Detail in the Internet banking system.

An e-PIN is entered as an additional element of security (on top of the one-time authorisation code you receive by text message) to confirm online payments via Debit Card. It is as an alternative to e-Token payment confirmation.

Not if you use the e-Token app to authorise online card payments. More details can be found here.

There are also certain exceptions, defined by law, where an e-PIN combined with a one-time authorisation code is not necessary. These are situations where strong authentication is not required (e.g. the payment is for a small amount or for a recurring subscription).

A separate e-PIN is issued for each Debit Card. If you hold multiple PPF banka Debit Cards (and you have online payments enabled for them), you will therefore have a corresponding number of e-PINs. You can change the e-PIN for each card via IB (in the detail of each of the Debit Cards).

If you don’t receive a text message with a one-time authorisation code within one minute, press the “resend SMS” option on the confirmation screen. If you still don’t receive a text message on the second attempt, contact your relationship manager.

Strong (two-factor) customer authentication (SCA) is mandatory for online payments within the EU. Online payment confirmation via your e-PIN may therefore not be required when you make payments to merchants. In the EU itself, there are also SCA exemptions, such as recurring subscriptions, parking fees, and amounts below EUR 30.

Please contact your relationship manager.